How do airlines become banks?

Airlines have entered banking by offering credit cards with travel rewards and establishing their financial services, leveraging their customer base and brand trust for additional revenue.

The Intersection of Airlines and Banking

In recent years, a notable trend has emerged within the aviation industry: airlines are expanding their operations beyond traditional travel services and delving into financial services. This strategic shift has led to the convergence of two seemingly disparate sectors: airlines and banking.

Regulatory Landscape: Airlines’ Entry into Banking

As airlines navigate the complex regulatory environment governing financial institutions, they encounter a myriad of challenges and opportunities. Understanding the regulatory landscape is crucial for airlines looking to venture into banking to ensure compliance and mitigate risks effectively.

Strategic Drivers Behind Airlines Becoming Banks

Several strategic imperatives drive airlines’ decisions to enter the banking sector. From diversification strategies to leveraging existing customer bases, airlines perceive banking as a means to enhance revenue streams and bolster their competitive position in the market.

Leveraging Customer Base: Airlines’ Advantage in Banking

Airlines’ extensive customer base is one of the inherent advantages of venturing into banking. By leveraging their loyal clientele, airlines can cross-sell financial products and services, thereby maximizing customer lifetime value and fostering long-term relationships.

Diversification Strategy: Airlines’ Move into Financial Services

Diversification is a fundamental principle guiding airlines’ foray into financial services. By expanding their offerings beyond traditional flight operations, airlines mitigate risks associated with market fluctuations and economic downturns, ensuring sustainable growth and resilience.

Key Challenges Faced by Airlines Venturing into Banking

Airlines encounter significant challenges when entering the banking sector despite the lucrative prospects. Regulatory compliance, risk management, and technological integration pose formidable obstacles that require careful navigation and strategic planning.

Case Studies: Successful Airlines—Turned Banks

Examining case studies of successful airlines-turned-banks provides valuable insights into evolving strategies and best practices. Airlines can glean valuable lessons for their banking endeavors by analyzing their approaches and outcomes.

Innovations in Airline Banking Products and Services

Innovation is at the forefront of airlines’ banking initiatives, driving the development of innovative products and services tailored to meet evolving customer needs and preferences. From co-branded credit cards to digital payment solutions, airlines are redefining the banking experience.

Impact on Traditional Banking Institutions

Airlines entering banking disrupt traditional institutions, driving fierce competition. This compels banks to innovate rapidly to maintain competitiveness.

Risk Management in Airlines’ Banking Operations

Effective risk management is paramount for airlines venturing into banking to safeguard against financial uncertainties and regulatory scrutiny. Implementing robust risk mitigation strategies and compliance frameworks is essential to maintaining operational stability and integrity.

Technological Integration: Airlines’ Transition to Banking

Technological integration plays a pivotal role in facilitating airlines’ transition to banking. Embracing digitalization, automation, and data analytics enables airlines to streamline processes, enhance efficiency, and deliver seamless banking experiences to customers.

Monetizing Loyalty Programs: Airlines’ Banking Initiatives

Airlines’ loyalty programs represent a valuable asset that can be monetized through innovative banking initiatives. By offering exclusive rewards, discounts, and incentives, airlines can incentivize customers to engage with their banking services, driving customer acquisition and retention.

Synergies Between Air Travel and Financial Services

The convergence of air travel and financial services creates synergies that benefit both industries. From travel rewards to integrated financial solutions, airlines capitalize on these synergies to enhance customer value propositions and differentiate themselves in the market.

Customer Experience in Airline Banking

The customer experience is paramount in airlines’ banking operations, shaping perceptions and driving loyalty. By prioritizing convenience, accessibility, and personalization, airlines can create immersive banking experiences that resonate with customers and foster brand loyalty.

Airlines’ Financial Sector Expansion

Expansion strategies play a pivotal role in airlines’ growth and diversification within the financial sector. From organic expansion to strategic partnerships and acquisitions, airlines adopt multifaceted approaches to penetrate new markets and segments effectively.

Regulatory Compliance: Airlines’ Obligations as Financial Institutions

Airline financial institutions must navigate regulatory compliance diligently to maintain trust, credibility, and legal compliance. Ensuring adherence to financial regulations and industry standards is imperative for their operations.

Partnerships and Collaborations in Airline Banking

Strategic partnerships amplify airlines’ banking prowess and market reach. Top of Form By forging alliances with financial institutions, fintech companies, and other industry stakeholders, airlines can leverage complementary strengths and resources to drive mutual growth.

Financial Inclusion: Airlines’ Role in Banking the Unbanked

Airlines promote financial inclusion by offering banking services to underserved populations through innovative outreach and community initiatives.

Revenue Streams for Airlines in Banking Operations

Diversification of revenue streams is a crucial objective for airlines in their banking operations. Beyond traditional ticket sales, airlines generate revenue through various channels, including interest income, transaction fees, and ancillary services, enhancing financial resilience and sustainability.

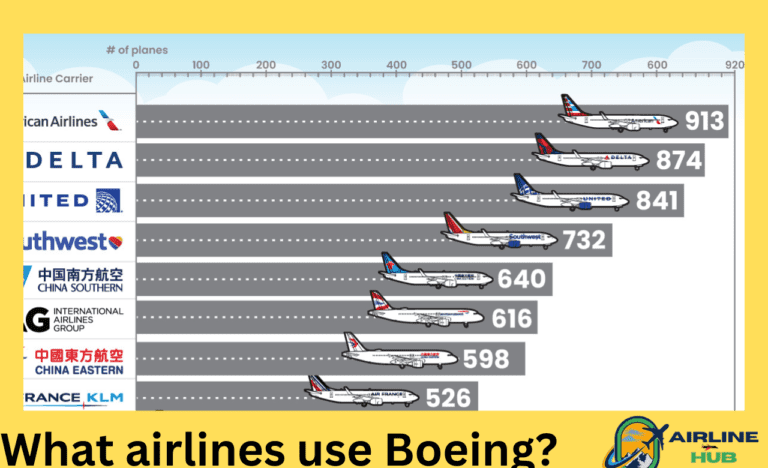

Global Trends in Airlines Venturing into Banking

The trend of airlines venturing into banking is not confined to specific regions but is observed globally. As airlines across continents recognize the strategic advantages of diversification, the landscape of the aviation and banking industries continues to evolve dynamically.

Corporate Governance Challenges for Airlines -Banks

Maintaining effective corporate governance is essential for airline banks to uphold transparency, accountability, and ethical standards. Implementing robust governance frameworks and oversight mechanisms is crucial to mitigating risks and upholding stakeholder trust.

Airlines’ Financial Market Marketing

Effective marketing is critical for airlines to stand out and compete in finance. From targeted advertising campaigns to branding initiatives, airlines leverage their brand equity and customer relationships to gain market share and drive growth.

Talent Acquisition and Training in Airline Banking

Securing top talent and providing robust training are vital for airlines entering the banking sector. This ensures the recruitment and nurturing of skilled professionals adept at navigating financial complexities. By investing in human capital, airlines bolster operational efficiency and drive innovation, laying a solid foundation for success in the competitive economic landscape.

Balancing Risks and Rewards in Airline Banking Ventures

Balancing risks and rewards is a fundamental challenge for airlines embarking on banking ventures. While the potential for revenue growth and market expansion is enticing, it must be weighed against inherent risks such as regulatory compliance, market volatility, and competitive pressures.

Brand Identity: Impact of Banking on Airlines’ Image

The transition into banking has profound implications for airlines’ brand identity and image. Effective branding strategies are essential to communicating the value proposition of airline banks and maintaining brand integrity amidst evolving consumer perceptions and market dynamics.

Future Outlook: The Evolution of Airlines as Financial Hubs

The future outlook for airlines as financial hubs is characterized by continued innovation, expansion, and adaptation to changing market dynamics. As airlines consolidate their position in the financial sector, they are poised to reshape the industry landscape and redefine the boundaries of traditional banking.

Lessons Learned from Airlines’ Banking Endeavors

Reflecting on lessons learned from airlines’ banking endeavors provides valuable insights for industry stakeholders and aspiring entrants. Understanding the critical success factors and pitfalls informs future decision-making and strategy formulation, from strategic alignment to operational execution.

Impact of Airlines Becoming Banks

The transition of airlines into banks has far-reaching social and economic implications, impacting stakeholders ranging from consumers to regulators and society at large. By fostering financial inclusion, driving economic growth, and reshaping market dynamics, airline banks contribute to socio-economic development and prosperity.

Conclusion

In conclusion, the convergence of airlines and banking represents a paradigm shift in the aviation and financial industries, driven by strategic imperatives, technological advancements, and changing consumer preferences. As airlines venture into banking, they navigate a complex landscape fraught with challenges and opportunities, requiring innovative approaches, robust risk management, and strategic partnerships. By capitalizing on synergies between air travel and financial services, airlines can enhance customer value propositions, diversify revenue streams, and reshape the future of banking. However, success in this endeavor hinges on effective governance, regulatory compliance, and customer-centricity, underscoring the importance of holistic approaches and continuous adaptation in a dynamic market environment.

FAQs

Airlines benefit from entering the banking sector by diversifying revenue streams, leveraging existing customer bases, and capitalizing on synergies between air travel and financial services.

Critical challenges faced by airlines venturing into banking include regulatory compliance, risk management, technological integration, and competition from traditional financial institutions.

Airlines monetize their loyalty programs through banking initiatives by offering co-branded credit cards, rewards, discounts, and exclusive benefits to cardholders, thereby incentivizing engagement with their banking services.

The transition of airlines to banks has significant social and economic implications, including fostering financial inclusion, driving economic growth, and reshaping market dynamics, thereby contributing to socio-economic development and prosperity.

Key lessons from airlines’ banking ventures: strategic alignment, operational execution, regulatory compliance, customer-centricity, and adaptive market response.

One Comment